24

Jan

As healthcare organizations start shifting their energies from the EMR implementations, managing the vast amount of data will ramp... read more

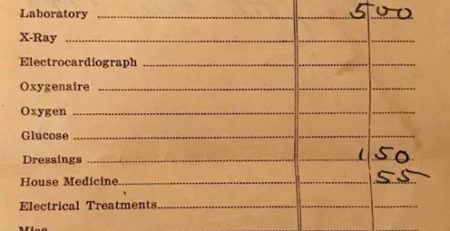

How much will my care cost? It depends… If you are reading this you might be feeling the same way... read more

Untangle the Healthcare Data Mess Every Christmas morning we had this unspoken contest of who could wake up with the... read more

Governance Landscape Health Care organizations are making progress on delivering improved transparent care, costs, and outcomes. Most integrated delivery systems... read more

It’s not about the technology Digital Health is a new buzz word that really means the convergence of people, processes,... read more

Leave a Reply